how we help

Banks & Lenders

- Access our Artwork Market Values, which equals the value of the loan collateral;

- Monitor Artwork Market Values, for changes in the value of the collateral;

- Analyze the risks and key drivers of the collateral value; and

- Proactively manage your loan portfolio.

overview

Enhance Your Credit Process for Art Secured Lending

Strengthen your due diligence, credit reviews, and monitoring processes for art-secured lending through our comprehensive art valuation platform. From the early stages of underwriting an art secured loan to liquidating an artwork due to a default, our platform allows Banks & Lenders to:

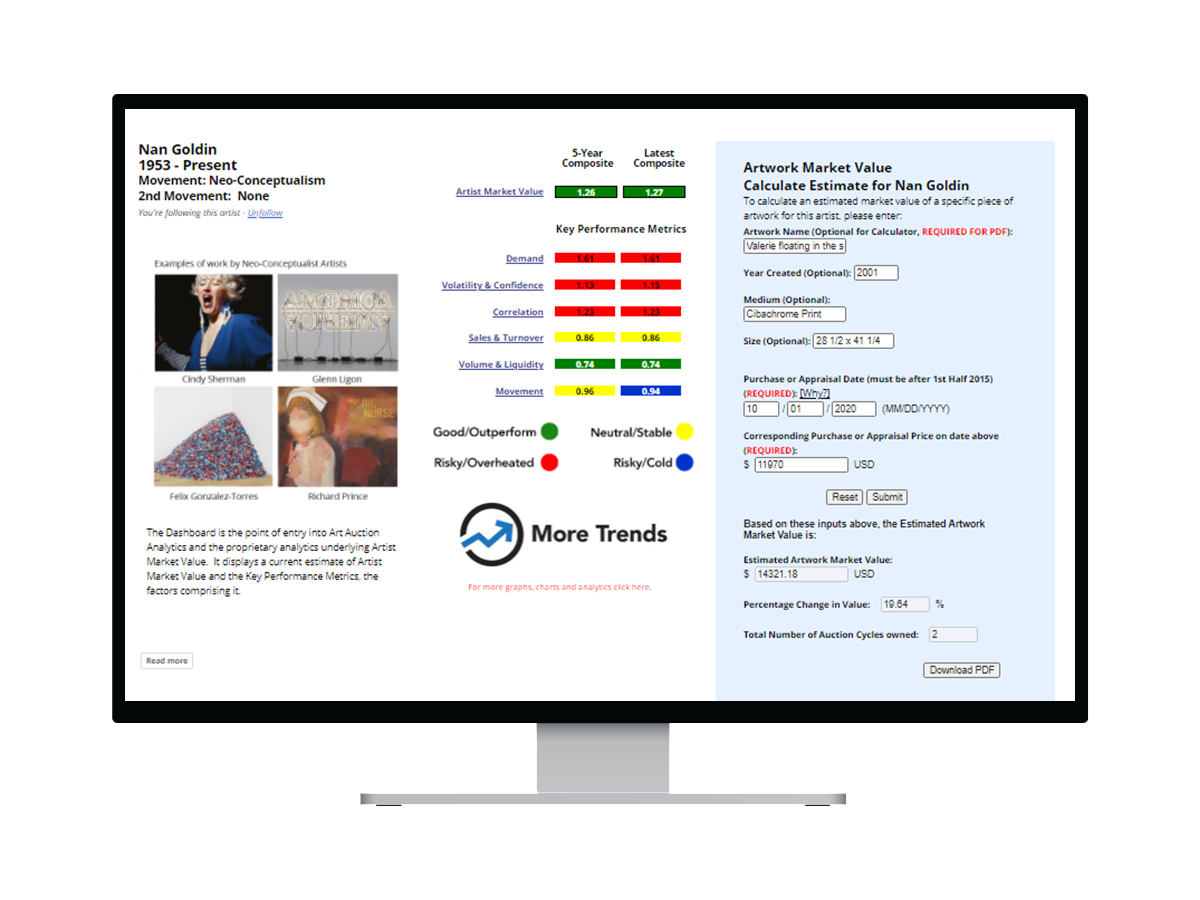

- Use the Artwork Market Value tool to calculate the value of an artwork to which an advance rate can be applied;

- Monitor the Artwork Market Values, for changes in the value of artworks that impact the established loan amount; and

- Access the accompanying AMVs and our suite of KPMs to analyze what is driving the changes in value.

Our standard and transparent market-based values ensure that every credit and lending decision is supported by comprehensive metrics that can be monitored and reviewed.

Access Artwork Market Value = Value of the Art Collateral

Use our Artwork Market Value tool to quickly obtain the market value of an artwork purchased or appraised within the last five years. The Artwork Market Value tool is driven by AMV and the underlying KPMs which provide the most comprehensive insights into what an artist’s artworks would sell for in the market today. This is the equivalent of the value of the art collateral. Apply your advance rate to the Artwork Market Value to determine the amount of your loan.

Monitor In-House

Take advantage of our Artwork Market Value tool, which is updated monthly, to regularly monitor changes in the value of collateralized artworks, in-house. Internal access to our standard valuations means you no longer have:

- To wait for third-party appraisals;

- Confirm the source of the appraisals; or

- Pass through the costs of appraisals to clients.

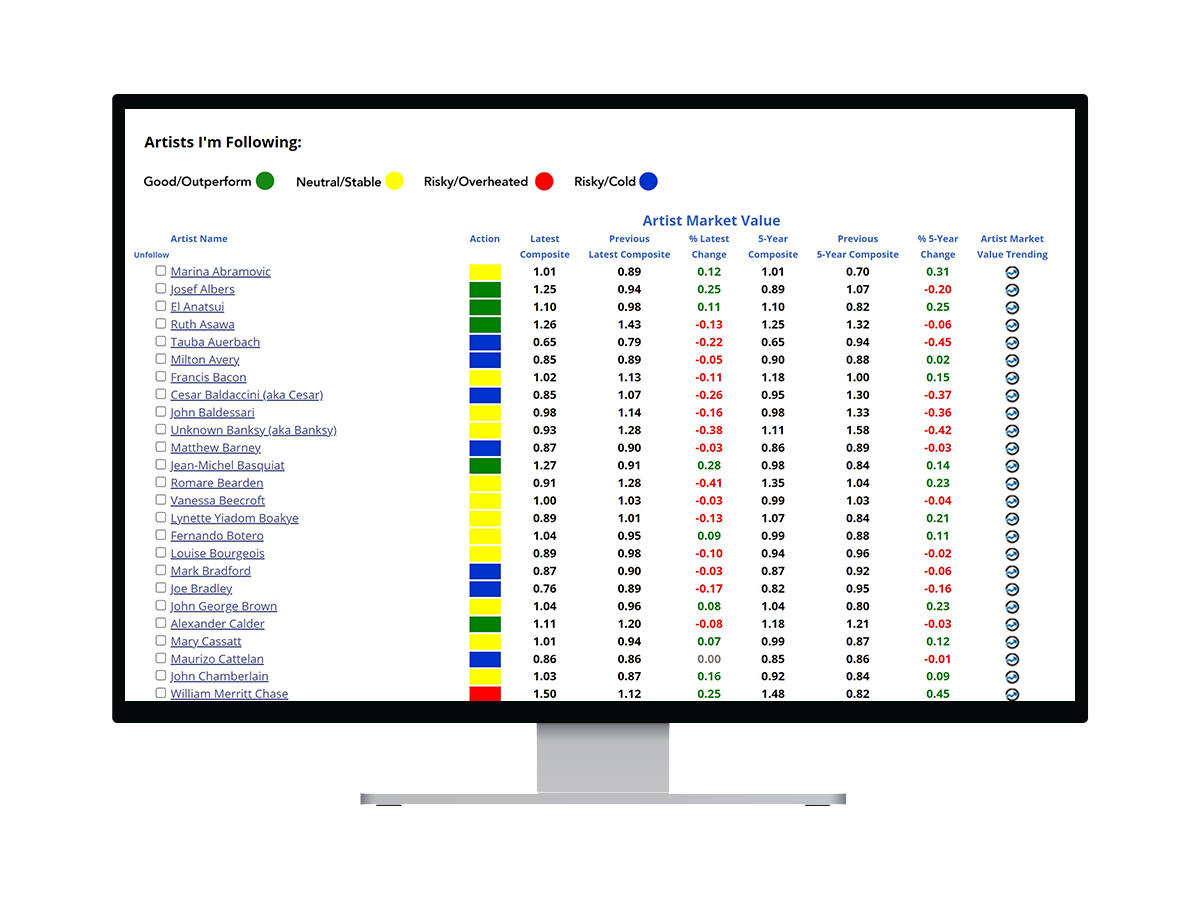

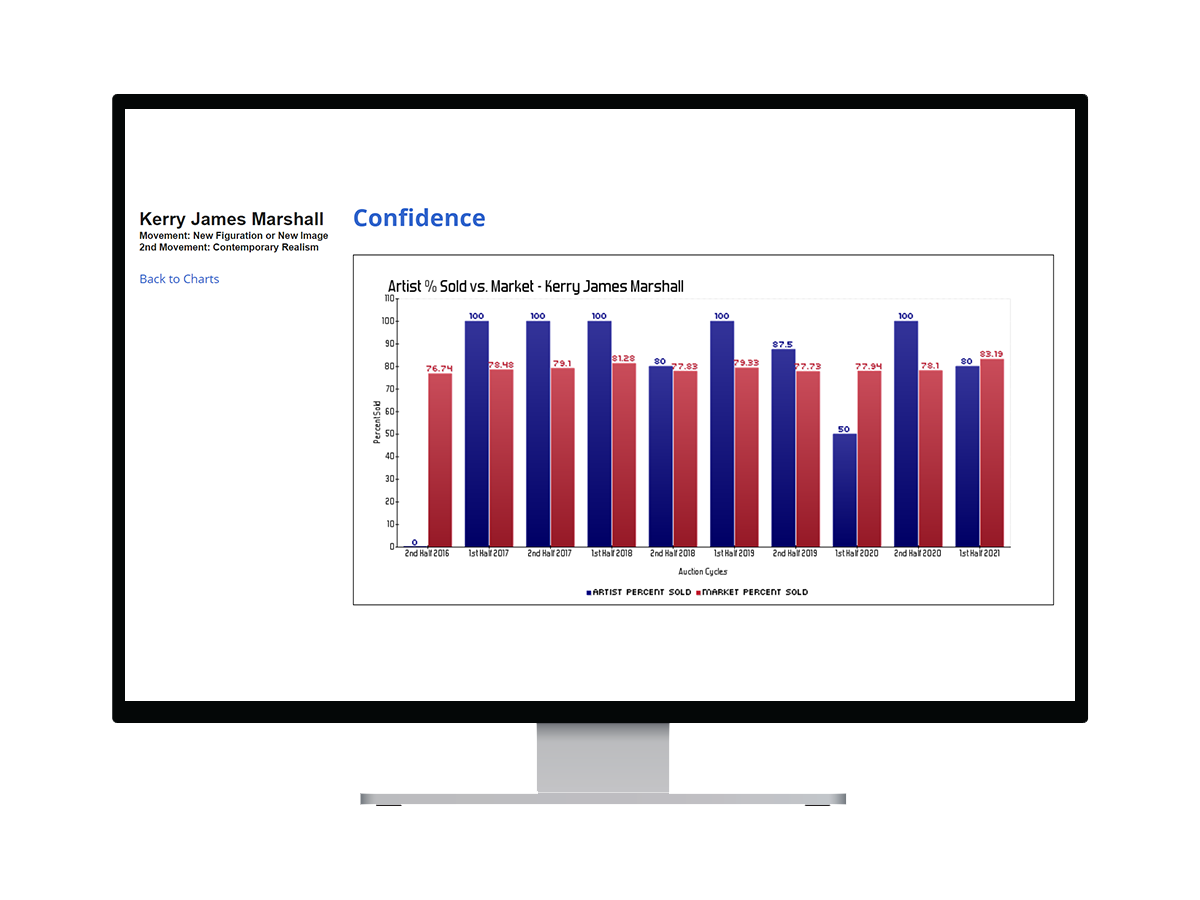

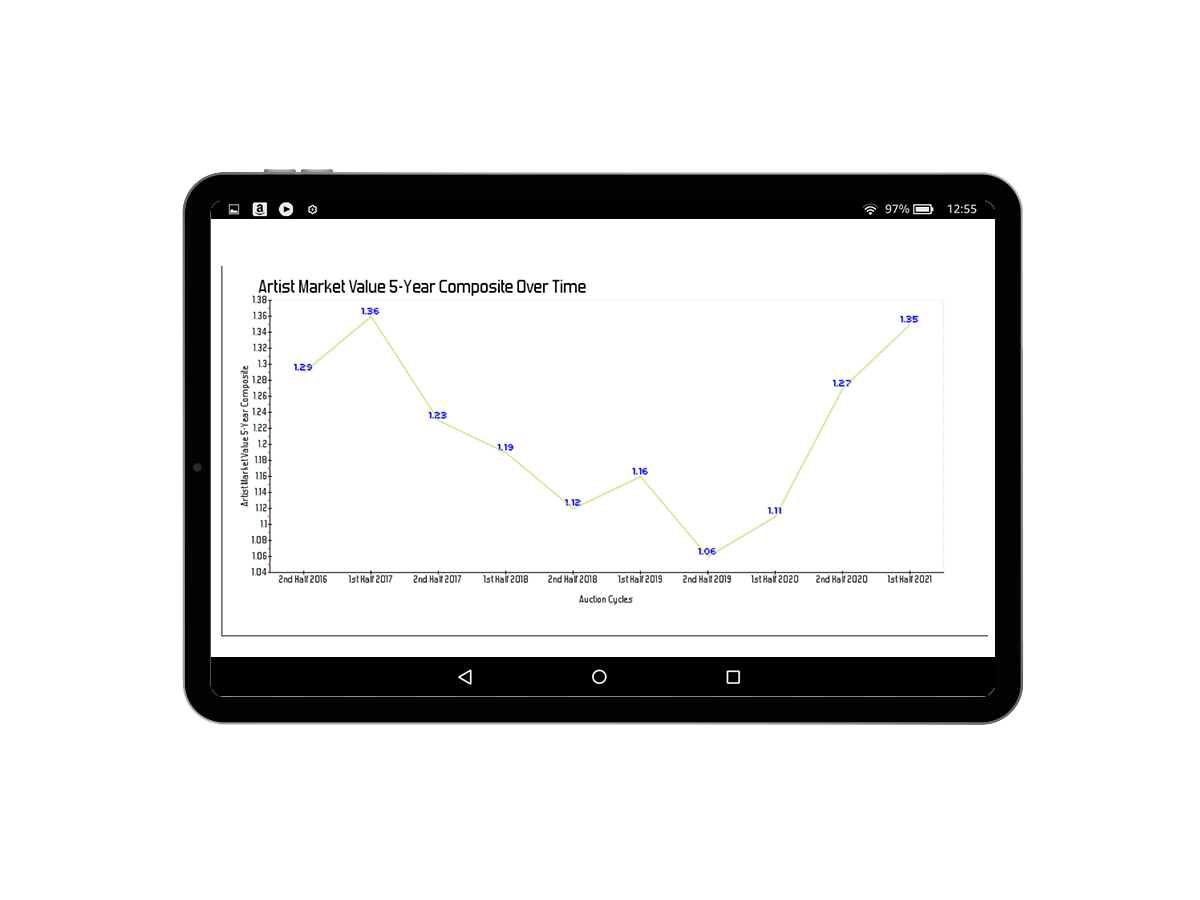

In addition, to the extent a change in value has been identified, uncover what is driving that value change. Art Auction Analytics’ extensive suite of metrics includes 20+ performance charts with five years of historical AMV and KPM metrics. Use our platform to access these metrics to analyze what is driving performance, and to spot risks.

Identify the Risks

We understand that art-secured lending presents a number of risks to Banks and Lenders, including:

- A change in the market value of the artworks collateralizing the loan results in the need for additional collateral, repayment of the loan; or

- A default on the loan, in which the Bank or Lender is left with illiquid collateral.

Art Auction Analytics’ platform was built to help Banks & Lenders get out in front of these risks:

- Use our AMV and KPM trending data to determine if the risk is temporary or has the probability to be long-term; and

- Use the Artwork Market Value tool to calculate the change in value, and to establish a price at which the artwork can be sold.

Optimally Manage Your Loan Portfolio

With Art Auction Analytics, you can proactively manage your loan book:

- Build loan covenants based on the Artwork Market Value or KPM trends that impact future Artwork Market Values.

- Expand your lending criteria to incorporate works that might have previously been excluded due to the costs (individual works or art, or more modest values).

- Manage the diversity of your lending portfolio, as you would any other asset, by assessing the value and volume of an artist in your loan portfolio, and consider hedging an overweighted artist.

position yourself

Stay Ahead of a Growing Market

As collectors continue to want to unlock the value of their art collection by borrowing against it, we only expect the art-secured lending market to continue to grow. With this growth comes added scrutiny to actively manage loan books, not only internally, but from outside regulators. We believe that reliance on annual outside appraisals is no longer enough. Regulators want to see detailed files supporting lending portfolios, including comprehensive credit files with an in-depth analysis of value.

keep pace with the art market

Analytics that Last

Art Auction Analytics provides you with sophisticated data-backed tools to support and monitor your loan portfolio. With our platform, you can take advantage of the growing art market, with the peace of mind that you have the right level of diligence backing your lending decisions.