Originally published on May 10, 2021

As we head into the defining New York auctions this week, we can safely say that through April the market has been buoyant, and we expect it to stay that way. Artist Market Values (“AMVs”) have been strong and should remain so through the Post-War & Contemporary Art auctions. We see little downside risk in the near term.

The market is poised for a healthy May and this shows up in our Index Indicators and Bellwether Artist Indicators:

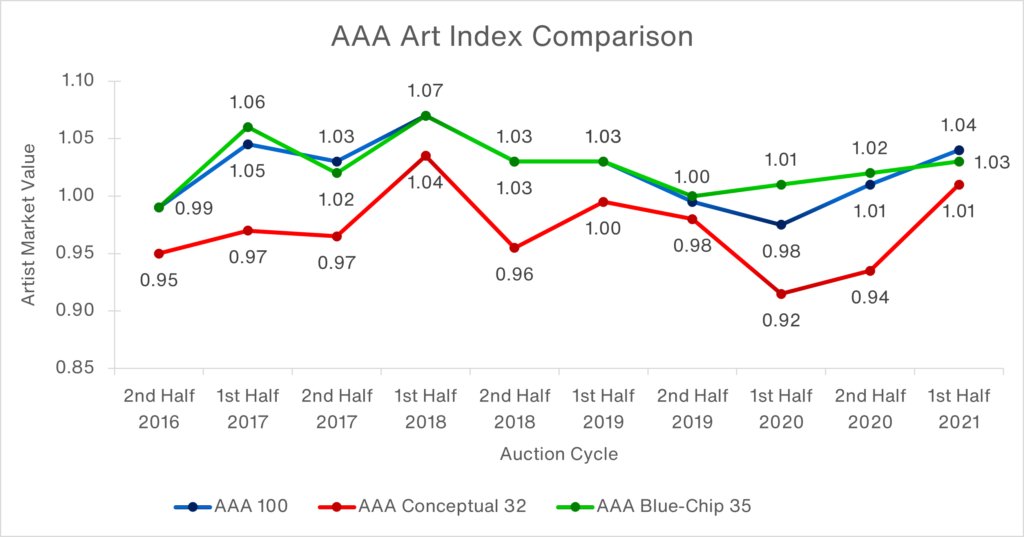

- Index indicators – The AAA 100, AAA Blue-Chip 35 and AAA Conceptual 32 all maintaining upward trajectories, with the AAA Conceptual 32 the more volatile of the three.

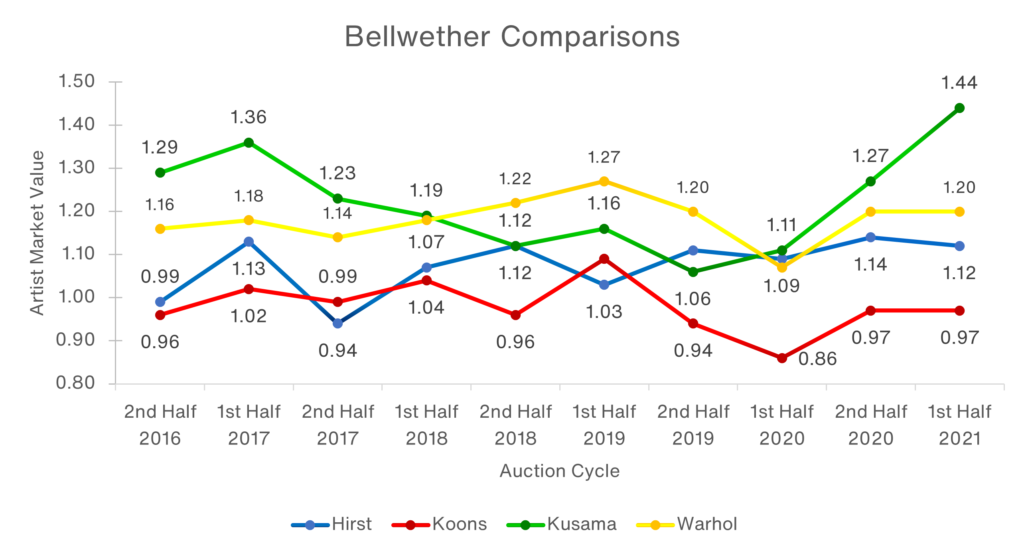

- Bellwether Artist Indicators – Four highly traded blue-chip artists, with three holding steady and one soaring in value.

Index Indicators: Observations

- The art market is hitting its stride in time for May. AMVs are trending upwards for all three indexes.

- The art market is hitting its stride in time for May. AMVs are trending upwards for all three indexes.

- Incremental gains exhibited by the AAA 100 and AAA Blue-Chip 35 are maintainable. Even though both are nearing historic highs their trends are smooth. Collectors are spending at all levels and we still seem to be in a high confidence/snap back from Covid mode.

- Do not be fooled by the sharp jump of the AAA Conceptual 32. It is attributable to significant appreciation in the AMS’s of three artists, with several comparatively low AMV artists realizing incremental, but still lower than the median, appreciation. Conceptual artists as a category are higher risk today, and the AAA Conceptual 32 could easily pivot.

Bellwether Artists: Observations

- Nothing in the bellwether artist trending hints at a downturn. The AMVs of three artists held relatively steady while that of the fourth, Kusama, has skyrocketed.

- Steady recent trending bodes well for the market. AMVs have realized comparatively little Auction Cycle-to-Auction Cycle volatility. Buyers are not making rash decisions typical of surging or sluggish markets.

- Kusama’s AMV might swing back but her normal is still very good. Today’s overheated market should be relatively short lived, and when it does normalize, it will stay within range. Demand for her work is strong and the market knows her value.

Our next update will be in early June. In the meantime, we have several indexes we are tracking. Just ask; if it is not an Index we are tracking, we probably could cook it up.

0 Comments