First Published March 26, 2021

In the past, the business of evaluating art was driven by connoisseurship. But the art market has been evolving. Institutions now are major factors in the market, and they need different tools. They must measure performance, and continuously monitor and update performance on a real-time basis. That is why they need what they use to evaluate any other type of investment: data. Banks, insurers, and wealth managers are fiduciaries, and just like high-profile art collectors, do not want to lose money on their investments. So, why do other asset classes such as stocks, bonds, loans, real estate, and insurance undergo more scrutiny than art when the auction market provides a wealth of measurables? The problem has always been translating the data into actionable information.

Art Auction Analytics was built to find the story within the data and bring it to life

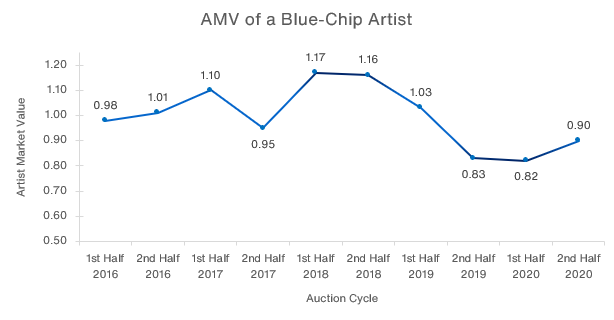

We do this by providing valuations and performance monitoring via a proprietary measure, Artist Market Value (AMV). AMV is comprised of several metrics (Key Performance Metrics of KPMs) including Demand (actual vs. expected price), Liquidity, Movement, among others. This allows you to look at value and its various components over time and to identify trends likely to affect it in the future. Because AMV is based on actual auction transactions, it is objective, verifiable, and easily accessible. It enables you to make major financial commitments with a high degree of confidence.

Monitoring AMV Shows that Even Blue-Chip Artists Can Go Out of Favor

Any asset will have swings in value, and you can’t afford to be blind to them. You also need to be able to anticipate changes. This chart highlights the movement of a particular blue-chip artist’s AMV over the past five years.

Conventional wisdom is that blue-chip artists, much like blue-chip stocks, maintain their value over the long term. Thus, they are safe bets. But, even blue-chip artists are not immune to fluctuations in value. If an artwork by this artist had been purchased in 2018, its value today would have declined by approximately 22%. When millions are at stake, that can be a devastating loss. But now, with data as your guide, you have got a new way to appreciate art for its beauty—and value.

Do you want to know who this artist is? Are there any topics you’d like us to cover in future posts? At Art Auction Analytics, we have AMV data on thousands of Post-War & Contemporary artists and transactions in the tens of thousands. Before you make your next investment, let’s talk. Next up: the power of Art Indexes

0 Comments